Cumene Prices, Trends, and Forecasts: Global Insights and Strategic Analysis

Get the latest insights on price movement and trend analysis of Cumene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa). As the global market dynamics shift, understanding the factors that influence Cumene pricing is essential for stakeholders across various industries. This comprehensive analysis will delve into the current and future market scenarios, helping businesses and investors make informed decisions.

Understanding Cumene

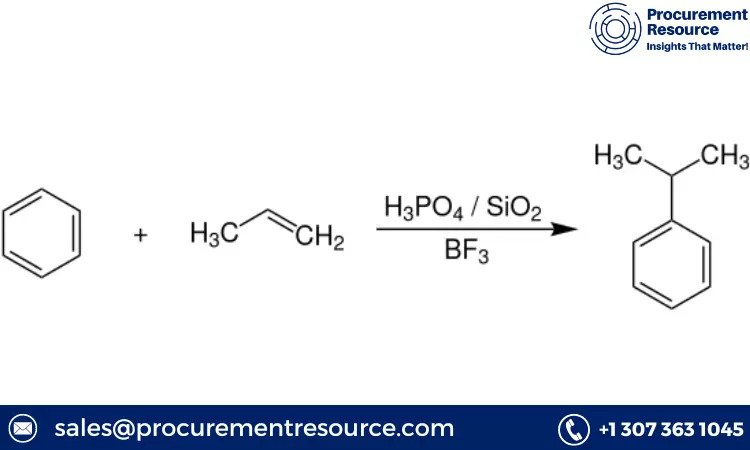

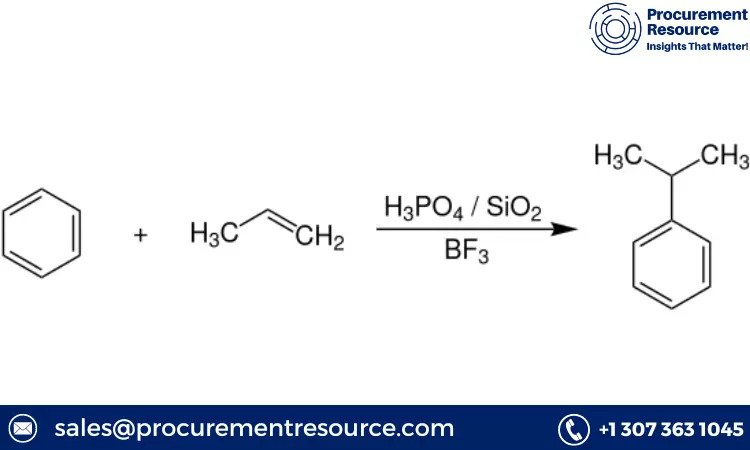

Cumene, chemically known as isopropylbenzene, is an organic compound that plays a critical role in the production of other chemicals. It is primarily used as a feedstock in the production of phenol and acetone, two chemicals essential in numerous industrial applications including the manufacture of plastics, fibers, and other organic compounds. The molecular formula for Cumene is C9H12, and it is derived through the alkylation of benzene with propylene.

Key Details About the Cumene Price Trend

Regional Analysis

- Asia: The largest producer and consumer of Cumene, Asia’s pricing trends are influenced by the operational rates of phenol-acetone plants, particularly in China and India.

- Europe: European Cumene prices are often swayed by fluctuations in benzene costs and propylene feedstock availability, alongside environmental regulations.

- North America: The market in North America is closely tied to the performance of the automotive and electronics sectors, which utilize products derived from Cumene.

- Latin America and Middle East & Africa: These regions are emerging in the Cumene market, with developing industries and increasing demand for downstream products influencing prices.

Request For Sample: https://www.procurementresource.com/resource-center/cumene-price-trends/pricerequest

Historical Data and Future Projections

Over the past decade, Cumene prices have exhibited volatility, driven by changes in raw material costs and market demand. Going forward, projections indicate a steady rise in prices, moderated by advancements in production technology and global economic conditions.

Industrial Uses Impacting the Cumene Price Trend

The primary demand for Cumene stems from its use in the production of phenol and acetone. Phenol itself is a precursor to many high-value chemical products such as bisphenol A (BPA), which is used in the production of polycarbonate plastics and epoxy resins. The automotive industry, which utilizes these plastics, directly impacts Cumene demand. Additionally, the electronics industry, which uses epoxy resins in circuit boards, also influences Cumene prices.

Key Players in the Cumene Market

Prominent players in the global Cumene market include:

- Royal Dutch Shell Plc

- ExxonMobil Corporation

- BASF SE

- SABIC

- The Dow Chemical Company

These companies not only lead in production but also in the development of new technologies aimed at increasing yield and reducing production costs.

Latest News For the Cumene Market

Recent developments have seen a surge in strategic partnerships and expansions:

- Investments in Production Capacity: Major players are expanding their production capacities in Asia to meet the increasing demand.

- Technological Advancements: Innovations in catalyst technologies are making the production process more efficient and environmentally friendly.

- Regulatory Impacts: Changes in environmental regulations are prompting companies to adopt greener practices and technologies.

Conclusion

As the global economy continues to evolve, so too does the Cumene market. Stakeholders need to stay informed about regional trends, technological advancements, and market dynamics to capitalize on emerging opportunities. For comprehensive market intelligence and strategic insights, Procurement Resource reports and resources provide invaluable support. Understanding the Cumene market’s intricacies is crucial for effective procurement and investment strategies.